Solana LST (Liquid Staking Token) “elSOL” White Paper v3 Released — Redesigning Stake as a Network Resource to Improve Efficiency and Strengthen Incentives

Solana LST (Liquid Staking Token) “elSOL” White Paper v3 Released — Redesigning Stake as a Network Resource to Improve Efficiency and Strengthen Incentives

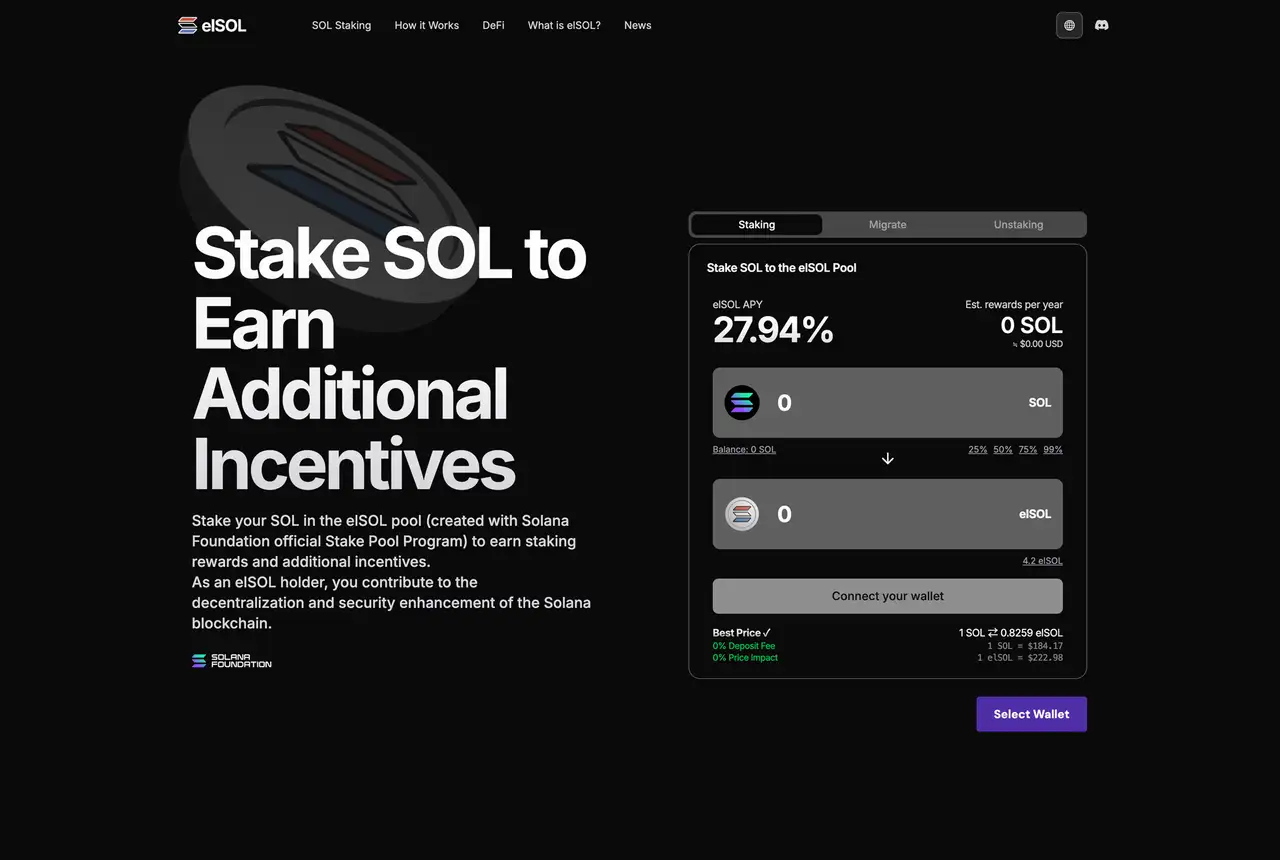

ELSOUL LABO B.V. (Headquarters: Amsterdam, the Netherlands; CEO: Fumitake Kawasaki) and Validators DAO have released version 3 of the white paper for “elSOL,” a Solana-oriented Liquid Staking Token (LST).

elSOL redefines Solana stake from a passive reward source into an active network resource that governs communication bandwidth (SWQoS: Stake-weighted Quality of Service). Version 3 systematizes SWQoS bandwidth utilization, the SSP (SOL Staking Power) market concept, and integration with the VLD token, while strengthening incentive design to support a more efficient and decentralized Solana network.

Design and background

In Solana, communication priority is determined by stake weight under the SWQoS model. Nodes and RPC endpoints with higher stake receive higher communication priority, but historically individual users and small projects have lacked mechanisms to reflect their stake in routing and bandwidth allocation.

elSOL addresses this gap by enabling stake to function directly as a network performance resource, allowing users to both earn staking rewards and apply stake-derived bandwidth to their RPCs and applications. This change aims to improve fairness of access to low-latency resources and to raise overall network efficiency.

- elSOL White Paper v3: https://storage.elsol.app/elSOLWhitePaperEN.pdf

elSOL reward structure

-

Maximizing staking rewards through zero validator feesAll elSOL validators operate with 0% commission. By eliminating validator fees and commissions, users receive Solana staking rewards without unnecessary reductions, effectively maximizing on-chain staking yield.

-

Additional incentives via 20% block-reward redistributionelSOL validators redistribute 20% of block-reward profits to the elSOL pool each epoch. This redistribution shares the gains from Validators DAO’s network optimizations with stakers and functions as a direct incentive to promote efficient network use. It also provides a baseline revenue stream even when the SWQoS market is not heavily utilized.

-

Bandwidth-market rewards through SSP and VLDStaking yields SSP (SOL Staking Power), which can be listed on the SWQoS market as bandwidth. When SSP is purchased, providers receive VLD according to the agreed rate. For SSP not sold on the market, VLD is distributed based on actual usage of shared SWQoS endpoints. This ensures fair compensation for all stake providers who contribute bandwidth resources.

Combined, these three revenue streams enable elSOL to sustain higher effective yields while aligning economic incentives with network performance.

SWQoS market, SSP and VLD mechanism

SSP issued from elSOL staking can be sold to developers and service providers that require SWQoS bandwidth. The SWQoS market uses VLD, a token issued by Validators DAO, as its settlement currency.

VLD can be minted at a reference rate of 1 USDC = 10 VLD (1 VLD = 0.1 USD); this mint price functions as the market’s anchor.

When market price falls below 0.1 USD, participants prefer market purchase and DAO minting pauses. When market price exceeds 0.1 USD, DAO minting becomes relatively cheaper than market purchase, new issuance occurs, and increased supply suppresses price escalation. This arbitrage mechanism keeps VLD price stable around 0.1 USD, preventing sharp spikes and crashes while allowing issuance to expand with real network demand.

VLD is minted only to satisfy actual bandwidth demand; oversupply is prevented. A maximum supply is set (10,000,000 VLD), and issuance does not exceed this cap. Through these controls, VLD accurately reflects Solana’s bandwidth demand and functions as an economic instrument for efficient bandwidth pricing and circulation.

Future roadmap

elSOL will release a beta of the SWQoS market in H1 2026 to validate bandwidth trading behavior and reward distribution using real traffic data. A public release is planned for H2 2026, creating an open market where validators, RPC operators, developers, and end users can participate on equal terms.

elSOL and VLD together aim to enhance Solana’s communication efficiency and economic autonomy by turning stake into a circulating network resource.

elSOL, ERPC and Validators DAO — solving core infrastructure issues

- Mitigating transaction failures and latency fluctuations common in RPC environments

- Overcoming performance limitations imposed by many infrastructure providers

- Reducing the impact of geographic distance on communication quality

- Lowering barriers for small projects to access high-quality infrastructure

Through the Epics DAO project (an open-source Solana NFT card game), we encountered the challenge that high-performance, low-latency Solana environments are not easily accessible.

We built a dedicated infrastructure stack and now deliver ERPC, SLV and elSOL based on that operational expertise.

By making high-quality connectivity and compute accessible, we aim to improve developer and user experiences across the Solana ecosystem.

- elSOL White Paper v3: https://storage.elsol.app/elSOLWhitePaperEN.pdf

- ERPC official site: https://erpc.global/en

- SLV official site: https://slv.dev/en

- elSOL official site: https://elsol.app/en

- Epics DAO official site: https://epics.dev/en

- Validators DAO official Discord: https://discord.gg/C7ZQSrCkYR

This article is not financial advice. NFA / DYOR (Not Financial Advice / Do Your Own Research).